FEATURED REPORT:

The World Market for Point of Care, 10th Edition

All of the POC IVD market in one volume. Glucose, COVID-19, flu, pregnancy and fertility, FOB, cardiac markers.

Point of care has made advances and this report provides markets for them. Kalorama’s report is like many reports in one.

The next five years of Point of Care will answer the top questions about the IVD market

How can diagnostics promote wellness? How can diagnostics improve patient-provider encounters? How can tests promote better selection and stewardship of drugs? How can tests facilitate patient home or nursing home of the future? How can diagnostics ensure the next pandemic, if and when it arrives is appropriately handled? The answers to these questions in many ways rely on the success of point-of-care solutions.

And because of this contribution, Point of Care diagnostics can earn a higher pricing and larger revenue growth than economized lab-based tests. The tests covered in this report tend to grow at higher rates than overall IVD market.

Kalorama’s report provides hundreds of data points useful for business planning and forecasts scores of market segments.

Point of care is a highly competitive market. There are many corporate profiles in this report.

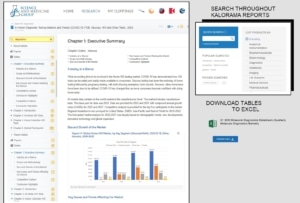

Instant Access to All of Kalorama’s IVD Market Research with a Subscription.

KNOWLEDGE CENTER: THE RIGHT WAY TO GO

Be ready with a Kalorama Knowledge Center Subscription, granting All Access to our elite market IVD market research reports, to every employee in your organization. With searchability, downloadable Excel sheets, figures and tables for presentations.

With a subscription to Kalorama Information Knowledge Center, everyone in your company can have access to information when they need it Scores of other companies have already signed up with Kalorama. Your organization too can have unlimited access to the reports that have been published and will be published. Setup is easy, pricing is reasonable and includes global licensing and unlimited usage. Contact our team today to get set up.

FOR MORE INFORMATION:

https://kaloramainformation.com/market-research-subscriptions/

SUBSCRIPTION: THE WAY COMPETITIVE COMPANIES USE RESEARCH.

Buying reports is time-consuming and slow-paced. It doesn’t match the pace of business. To succeed you need a library of knowledge, so that as questions come up, you can spend time making decisions, advising team members, avoiding issues, and sizing up the competition instead of looking through report websites for information.

SHARE WITH EMPLOYEES IN YOUR ORGANIZATION

Perhaps you are in an organization with multiple employees who need market data. Marketing wants market share data. Business planning wants market opportunity sizing, Sales wants to get a head start on a lead list. Your R&D head needs crucial backup for a product launch decision. The CEO wants to know if a potential M&A target is all that or all hype.

EMAIL US: [email protected]

PHONE: (US): 703-778-3080

CONTACT US w/ Your Specific Questions and Needs. A Representative Will Contact You.

Kalorama Information KNOWLEDGE CENTER

A subscription to the Kalorama Information Knowledge Center gives you access to hundreds of reports featuring

authoritative market research on the medical and healthcare sector.

Kalorama Information provides the key market data, trends and insights you need to drive your business strategy and growth. Explore our latest research.

Biotechnology

- The Worldwide Market for Liquid Biopsy, 6th Edition$5,000.00 – $10,000.00Liquid biopsies have emerged as a minimally invasive diagnostic tool, analyzing tumor-derived materials circulating in biological fluids to offer valuable information for cancer diagnosis, treatment, and monitoring. While tissue biopsies and imaging techniques remain standard in solid tumor diagnosis, liquid biopsies present an alternative or complementary approach, addressing some of the limitations and risks associated […]

- The Market for RNA Sequencing, 3rd Edition$5,000.00 – $10,000.00The sequencing market has continued to provide powerful tools that hold the promise of bringing major changes to healthcare in the near future. In the last decade, explosive growth has occurred in terms of product introductions, new applications, and the end-user labs rushing to participate in these new areas. In recent years, the use of […]

- The Market for Single Cell Analysis in Genomics: Next-Generation Sequencing and Other Technology, 2023-2027$5,000.00 – $10,000.00The Market for Single Cell Analysis in Genomics: Next-Generation Sequencing and Other Technology, 2023-2027 focuses on the market for single cell genomics products. Analyzed are the hardware, service of the hardware, software, and consumables included for the sequencing step and other types of downstream analysis. Single cell RNA-seq enables new types of analyses, for instance: […]

- The World Market for Liquid Biopsy, 2023$6,000.00 – $12,000.00Dramatic changes have occurred in the liquid biopsy market, necessitating a resource to provide perspective on the market opportunity. This new report from Kalorama assesses the Liquid Biopsy Market now and in 2027. The report can be useful for business planning, market share assessment, competitive research, and due diligence for mergers and acquisitions and other […]

Diagnostics

- Molecular Diagnostics Quarterly Datastream, 2024$10,500.00NOTE: The Kalorama Molecular Diagnostics Quarterly Datastream is only available to those who have purchased our Worldwide In Vitro Diagnostic Tests report, World Market for Molecular Diagnostics report or Molecular Point-of-Care (mPOC) report. All in any edition. This is because this is a quarterly update to markets covered in these reports. The most up-to-date information for company-wide success. Buyers […]

- The Worldwide Market for Point-of-Care (POC) Diagnostic Tests, 2024$7,000.00 – $14,000.00NOW IN ELEVEN EDITIONS—The Worldwide Market for Point-of-Care (POC) Diagnostic Tests forecasts the POC market through 2028. Lab-based analyzers in hospitals and reference labs are the cornerstone of revenues in the in vitro diagnostics (IVD) industry. However, the point-of-care (POC) segment is seen as a key growth area. Point-of-care refers to tests that can provide […]

- In Vitro Diagnostic (IVD) Trends and Market Update: March 2024$5,000.00 – $10,500.00Diagnostic testing has become a fundamental aspect of healthcare, aiding physicians in diagnosing conditions and determining treatments. Despite a decline in COVID-19 testing affecting total revenues, core diagnostic segments have generally experienced growth. Factors such as new products, changes in global health spending, regulatory shifts, and disease trends contribute to a constantly changing market, yet […]

- 30-Country IVD Market Atlas, 2024 (In Vitro Diagnostic Markets for US, China, Germany, UK, Saudi Arabia, India, UAE, France, Vietnam, Turkey and 20 Other Countries)$5,000.00 – $10,500.00What’s Included One Report Covering 30 Countries Sizing for 20 Important IVD Market Segments Segments Estimated for Each Country Forecasts to 2028 for Each Segment Updated Quarterly (4 updates annually) to Reflect Market Changes Over 2800 Data Points About the Report With over two decades of experience in publishing in vitro diagnostic (IVD) market research, […]

Medical Devices

- Remote Patient Monitoring and Telehealth Markets, 13th Edition$5,000.00 – $10,000.00Telehealth and remote patient monitoring have become integral to improving health conditions and preventing health complications. The transformations observed during the pandemic have bolstered telemedicine and, consequently, remote patient monitoring, instilling confidence in virtual patient assessment and access to advanced technological monitoring. Since January 2019, remote patient monitoring has experienced a significant surge, and current […]

- The Global Market for Medical Devices, 13th Edition$5,000.00 – $10,000.00The medical device industry, commonly referred to as the medtech industry, plays a pivotal role within the broader healthcare sector. This industry undergoes continuous evolution due to ongoing advancements in technology, equipment, diagnostic tools, and medical devices. These innovations have the profound impact of extending and enhancing the lives of patients, promoting longevity and well-being. […]

- The Market for Medical Devices, 12th Edition$5,000.00 – $10,000.00The medical device industry, often referred to as the medtech industry, is an important aspect of the entire healthcare industry. The medical device industry is constantly updating and changing through the continued development of new technologies, equipment, tests and devices. Advancements in the medical device markets are life-changing and are allowing patients to live longer, […]

- Remote Patient Monitoring and Telehealth Markets, 12th Edition$4,000.00 – $8,000.00The global patient monitoring and telehealth market has continued its expansion in both the institutional and home segments of the health market with the United States and many European countries at the forefront of implementation. Market numbers discussed in this report are focused on the global patient monitoring and telehealth market with special market coverage […]

Pharmaceuticals

- The World Market for Vaccines, 2024$5,000.00 – $10,500.00Vaccines offer long-term or permanent immunity against diseases. They have been a cornerstone of preventive medicine for over 70 years, stimulating an immune response to specific diseases. The widespread adoption of effective vaccines has led to the near-elimination of many deadly diseases, making vaccination one of the greatest public health achievements of the 20th century. […]

- Cell and Gene Therapy Funding and Deals Analysis: Financings, Partnering, M&A, Tech Transfers, IPOs/SPACs, Other Deals, 2021-2023$5,000.00 – $10,000.00While the concepts of gene therapy and cell therapy have been investigated for decades, there were major challenges in the early years. Through incremental progress, and the gradual introduction of enabling tools such as CRISPR and next-generation sequencing (NGS), cell and gene therapy has emerged into a highly active area. There are now many approved […]

- Cell and Gene Therapy Market and Deals Analysis, 2023: Financings, Partnering, Mergers and Acquisitions, Tech Transfers, IPOs, and Other Deals$5,000.00 – $10,000.00This report, Kalorama’s Cell and Gene Deals and Market Analysis, tracks the dealmaking and market opportunity in cell and gene therapy. The report includes specific details of 1000+ deals from 2022-2023. A lot of attention is being given to the areas related to cell and gene therapy (CGT) recently. Kalorama’s CGT deals amounted to a […]

- Precision Cancer Therapeutics Market, 2022$5,000.00 – $10,000.00Despite advances in cancer treatment, cancer continues to affect about 18.1 million people annually, generating a significant loss of life, financial burden and overall strain on the health industry. Worldwide between 35 and 40 million people are living with cancer and nearly 10 million people lose the battle annually. The most common cancers affecting the […]

Contact Us

Email Us: Customer Service

Phone (US): 703-778-3080

Fax: 703-778-3081

-

Pay Invoice

Follow Us!

Latest Blogs

- How Market Research Supercharges Laboratory Diagnostics Go-To-Market Strategies April 24, 2024

- 4 Key Components to a Winning Go-To-Market Strategy April 24, 2024

- Immunoassays: A $27 Billion Market of Intrigue and Opportunity April 12, 2024

- IVD in Egypt: $440 Million Market Lead by Immunodiagnostic and Molecular Diagnostic Growth April 11, 2024

- Momentum in Multiplex Testing for IVD April 1, 2024

Sitemap

Your Data and Privacy

About Us

Kalorama Information, part of Science and Medicine Group, has been a leading publisher of market research in medical markets, including the biotechnology, diagnostics, medical device, and pharmaceutical industries for more than 30 years. Our comprehensive, timely, quality research and innovative approach to analysis and presentation of market intelligence have made Kalorama Information a premier source of market information for top industry decision makers.

Visit Science and Medicine Group

Visit Science and Medicine Group